PYUSD: PayPal's stablecoin supply on Solana exceeds that on Ethereum

- PayPal's dollar-backed stablecoin PYUSD has seen its supply on Solana surpass that on Ethereum, despite initially launching on the latter network in August 2023.

- Since its introduction on Solana on May 29, PYUSD has enjoyed growing adoption, particularly through its inclusion in liquidity pools on decentralized exchanges like Jupiter and Orca.

- With a market capitalization of $733 million, PayPal ranks as the fourth-largest issuer of centralized stablecoins, behind Tether (USDT), Circle (USDC), and First Digital (FUSD).

THE PayPal's PYUSD stablecoinbacked by the US dollar, is experiencing notable expansion on the network Solana. DefiLlama data shows that PYUSD supply on Solana has now surpassed that on Ethereummarking a significant milestone for this stablecoin launched by PayPal.

Comparing Solana vs Ethereum Offerings

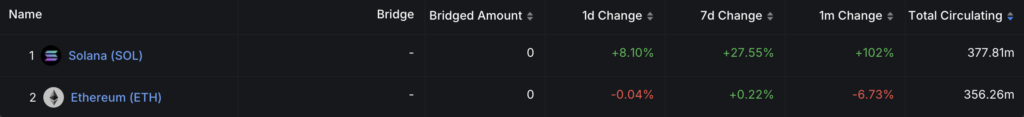

Since his Introduction to Solana on May 29, 2024the offer of PYUSD reached 377 million tokens on this network, while on Ethereum the supply stands at 356 million tokens. This difference reflects a growing adoption of the stablecoin on Solanadespite the fact that it was initially launched on Ethereum in August 2023 in collaboration with the custody company Paxos.

History and development of PYUSD

When PayPal Launches PYUSD on Ethereumthe stablecoin quickly reached a supply of 230 million tokens before the end of 2023. Since then, the total supply of PYUSD has tripled to over 733 million tokens in circulation, placing PayPal among the top centralized stablecoin issuers.

PayPal's Market Position in the Stablecoin Ecosystem

PYUSD Expansion on Solana can be attributed to several factors. Solana-based decentralized exchanges like Jupiter and Orca have added PYUSD to their liquidity pools, strengthening its presence on the network. This inclusion, coupled with the coexistence of major stablecoins like USDC and USDT on Solana, has driven the rapid adoption of PYUSD.

With a market capitalization of $733 million, PayPal Positions Itself as Fourth-Largest Issuer of Centralized Stablecoinsbehind giants like Tether (USDT), Circle (USDC), and First Digital (FUSD). For comparison, USDT and USDC dominate the market with respective capitalizations of $120 billion and $36 billion.

Future prospects

THE PYUSD supply on Solana exceeds Ethereum could signal a shift in blockchain network dynamics for stablecoins. Despite PayPal’s cgoix stance, PYUSD adoption was disappointing on Ethereum.

There PYUSD performance on Solanaa network known for its fast transactions and low fees, could continue to attract additional users and integrations into the crypto ecosystem. This could also influence the PayPal strategy and other market participants regarding the future distribution of their digital assets.

The article PYUSD: PayPal's stablecoin supply on Solana exceeds that on Ethereum appeared first on Coin Academy