Crypto news for the week of August 5, 2024: Coin Hebdo #154

Le Coin Hebdo is the essential meeting place to stay informed about the news of the week on cryptocurrencies, NFTs, DeFi and GameFi!

CoinAcademy unveils new, completely free training course to get started in crypto

What’s behind this week’s crypto CRASH?

The market crashed this week due to three main factors :

- Of the macroeconomic concerns linked to the fear of a growing recession, exacerbated by a Surprise rate hike in Japan which caused massive liquidations.

- Events global policies have intensified panic, including tensions in the Middle East and uncertainties surrounding the US election.

- Of the aggressive asset sales by Jump Trading and massive withdrawals from large investment firms have amplified the fall in cryptocurrency prices.

Vitalik presents his vision for interoperability between Ethereum layers 2

Vitalik predicts that zk technology will be adopted by all rollups in about five years, further improving compatibility and transaction finalization on Ethereum

EIP-3370: new address standard

One of the proposals on this roadmap isthe EIP-3370which introduces anew address standardintended to be adopted by wallets and decentralized applications. This standard will allowto display channel-specific addressesusing a human-readable prefix, thus simplifying the user experience.

EIP-7683: Communication between layer 2 networks

Another important step isEIP-7683which aims to create astandardized way for Ethereum's different layer 2 networks to communicateand execute cross-chain transactions. Currently, it is complex and often inefficient for users to exchange assets between different networks. Establishing standardized rules that all chains can follow will alleviate this problem.

EIP-3668: Off-chain data access

The EIP-3668provides a standardized way for Ethereum smart contracts toaccess off-chain data. Vitalik calls these solutions “layer-2 thin clients“, as they aim to standardize how Ethereum contracts can use off-chain data, making it easier and more efficient to develop applications that require large amounts of data without incurring high on-chain storage costs.

Jump Trading continues to withdraw and sell its ethers

Jump Trading recently removed 11,500 ETH (either $29 million) from Lido Finance to an address frequently used to deposit tokens on centralized exchanges, suggesting a potential sale.

Despite this withdrawal, Jump Trading still retains 16,292 ETH ($41 million), 21 394 WSTETH ($63 million), and 19 049 STETH being unlocked.

The selloff comes after a series of similar moves that contributed to a massive selloff in Ethereum, exacerbated by macroeconomic factors and industry-specific events such as the investigation by the CFTC and the outflow of funds from Grayscale.

Ethereum: Nomad Bridge Hacker Uses Stolen DAI to Invest $40 Million in ETH

A hacker having exploited the Nomad bridge in 2022 took advantage of the fall of the crypto market to buy 16,892 ETH with 39.75 million DAI stolen, at an average price of $2,350 per ether.

After this purchase he used Tornado Cash to hide transactions, making funds difficult to trace.

Ethena Labs Integrates Its USDe Stablecoin on Solana, Offers SOL as Backing Asset

Ethena Labs has integrated its stablecoin USDe on the blockchain Solanaenabling transactions on DeFi platforms such as Kamino, Orca, Drift And Jito.

In addition to this integration, Ethena offers to add GROUND as a backing asset to strengthen the security of USDe, thereby increasing its adoption and potentially unlocking up to $3 billion of open interest in the SOL futures market.

SOL: Brazil approves one of the world's first Solana Spot ETFs

There Brazilian CVM approved the creation of the first Solana Spot ETF in Brazil, which will be managed by QR Asset And Vortx.

This ETF, among the first in the world, still needs to receive approval from the Brazilian stock exchange B3 before becoming operational, consolidating Brazil's position as a key market for regulated crypto investments.

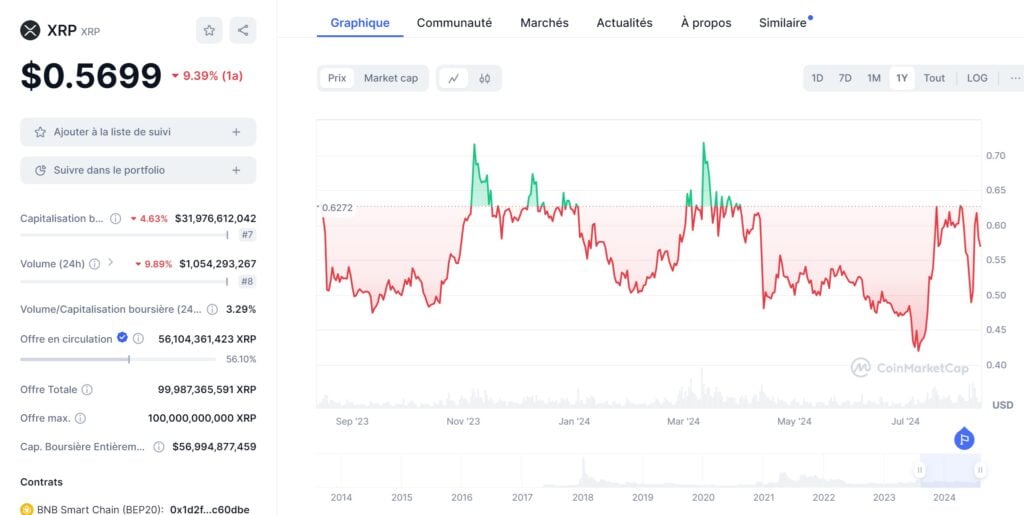

Judge Fines Ripple $125 Million, Less Than $2 Billion Asked by SEC

A federal judge has imposed a fine of $125 million has Ripple for violations of federal securities laws in institutional sales of XRPwell below the nearly 2 billion dollars claimed by the DRY.

Sales of XRP to individuals through exchanges were not found to be in violation, and Ripple will now have to register any future sales of securities.

Judge orders FTX, Alameda to pay $12.7 billion, bans them from crypto trading

A New York judge has ordered FTX and Alameda Research to pay 12.7 billion dollarss to their creditorsputting end to 20-month lawsuit initiated by the CFTC.

FTX and Alameda are now banned from trading digital assets and acting as market intermediariesmarking the end of their activities in the crypto sector.

FTX’s reorganization plan calls for a 118% return for creditors with claims under $50,000, although many creditors would prefer to be repaid in crypto.

More information on this case

More information on this case

Donald Trump Jr. Announces DeFi Platform to Challenge Banking System

Donald Trump Jr. announced the launch of a platform Challenge aiming at challenge the banking system traditional and to combat inequalities in access to financial services.

This ambitious project, still in the development phase, focuses on creating decentralized finance accessible to all, especially those excluded from the conventional banking system.

Market crash: experts call on the Fed to urgently cut interest rates

- Some experts see buying opportunities in the current decline, reminiscent of historical post-crisis rebounds, such as in 2020 with Bitcoin.

- Other experts are calling for an urgent Fed rate cut after a sharp decline in global financial markets and a disappointing jobs report.

- Jeremy Siegel and Nigel Green recommend immediate cuts to avoid a recession, calling for up to 1.5% rate cuts this year.

At its last meeting, the Fed maintained the interest rate between 5.25% and 5.5%, but a disappointing jobs report and recent macroeconomic factors have pushed experts, such as Jeremy Siegel of the Wharton School, to call for an emergency rate cut of 0.75% for this August, with another 0.75% cut in September, criticizing the Fed's slowness in its adjustments.

Ronin (RON) Bridge Suspended After $12 Million Hack

In March 2022, the Ronin cross-chain bridge Ethereum link suffered a historic hack with more than $600 million stolen, marking one of the largest hacks in the DeFi ecosystem.

Unfortunately, a new attack hit Ronin on August 6, 2024, where a hacker managed to siphon off nearly 4,000 ETH And 2 million USDCtotaling approximately $12 million.

Fortunately, this attack was thwarted by a MEV bot, likely acting as a white hatwhich made it possible to secure and return the funds.

Although the funds were saved, this event still tarnishes the reputation of Ronin. The project had previously been called “cursed” by crypto investigator ZachXBT, in reference to the massive theft in 2022. This latest hack comes as Ronin continues to hunt down funds stolen two years earlier, including $5.7 million were recently recovered by Norwegian police.

News in brief

- Capula Investment Management: Europe's 4th largest hedge fund says it has invested $500 million in Bitcoin ETFs

- Kiln Unveils Kiln DeFi, a Service Simplifying Access to DeFi Rewards on Stablecoins

- STRK: Diego Oliva steps down as CEO of Starknet Foundation

- Stripe and Bitstamp Announce Partnership to Facilitate Fiat and Crypto Conversions in Europe

- Altcoins: Grayscale offers 2 new investment funds for TAO and SUI

- Do Kwon's extradition to South Korea delayed again by Supreme Court

- Immutable Announces Closure of NFT Marketplace as Volumes Drop

The article Crypto news of the week of August 5, 2024: Coin Hebdo #154 appeared first on Coin Academy